All your bills.

One place.

One number.

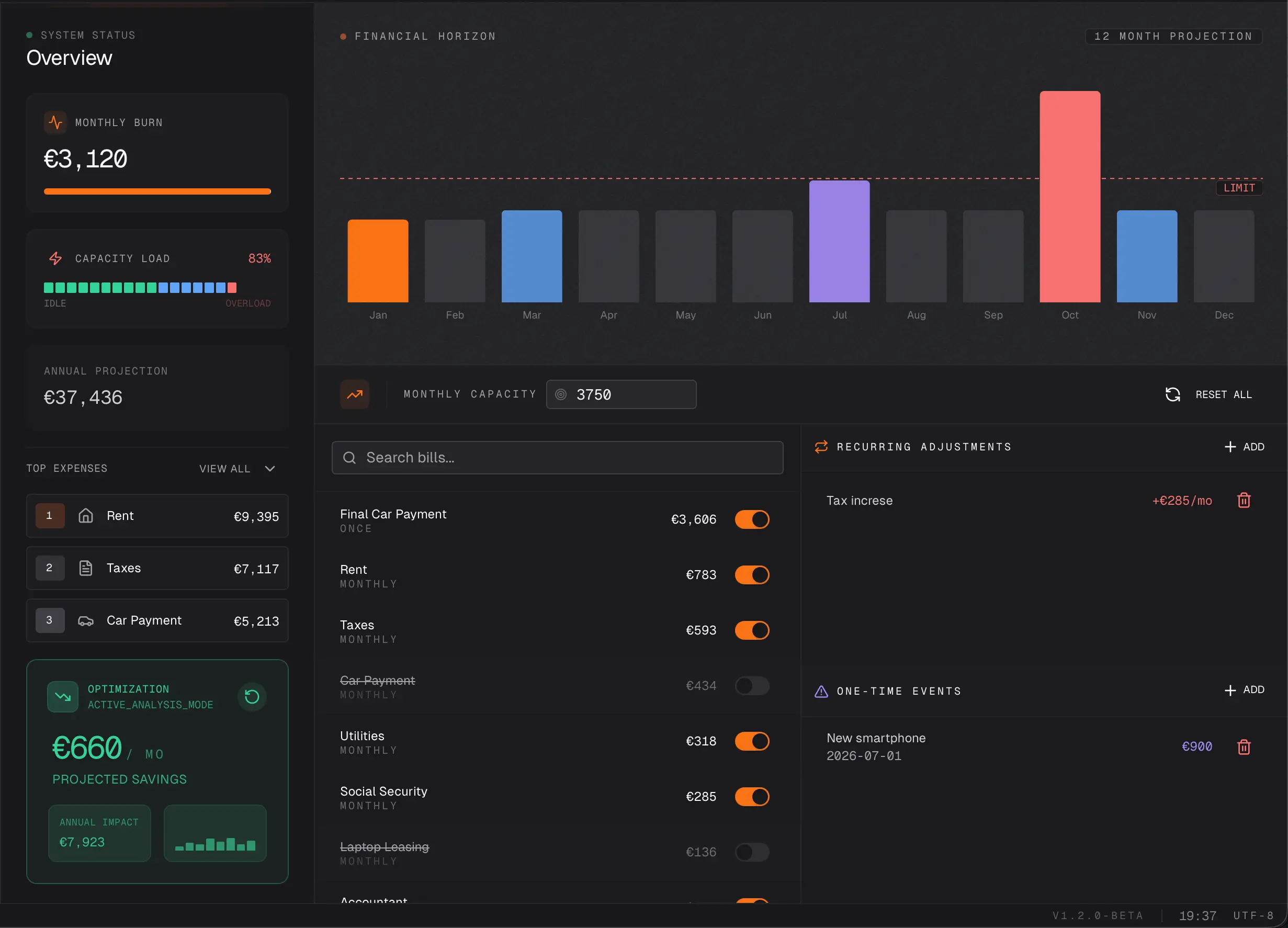

Subscriptions, rent, utilities — everything that repeats. See your total and what's due next.

"I already have a system"

Most people manage bills with one of these. All of them break eventually.

- × Works until you have 10+ bills

- × Forget one — get a late fee

- × Constant low-key stress

- × No amounts, just "pay electricity"

- × No total picture of the month

- × Have to create each one manually

- × You have to maintain it yourself

- × No reminders when payment is due

- × Gets outdated fast

- × Shows what happened, not what's coming

- × Doesn't know your Netflix price went up

- × Can't simulate "what if I cancel this?"

- × Not available for variable bills

- × You lose track of price increases

- × Can overdraft if timing is off

What StediPay does instead

Shows what's coming, not what already happened. You control what's tracked.

You add what matters

No bank connection. You decide what to track. Your bank doesn't know you're canceling the gym next month.

See the future, not the past

12-month forecast. Know about expensive months before they hit. Simulate changes before committing.

Stays on your device

Everything stored locally. No cloud account required. Works offline.

Built for planning sessions, not quick glances. Desktop app.

The guessing game

Without tracking, monthly spending is just a guess. Forgotten bills lead to overdrafts.

Your payment calendar

See every payment coming. Day by day.

Netflix Subscription

Electric Bill

Spotify

Gym Membership

Rent Payment

See what's coming

Spikes are expensive months. You'll know ahead of time.

What-if scenarios

Test purchases and changes before committing.

Adding $2,400 in March puts you $400 over your usual capacity.

Try April instead?

How people

use it

Real scenarios from everyday planning.

Can I afford this?

Add a $1,200 laptop to April. See if your budget still fits. If not, try May.

Weekly check-in

Open the calendar. Mark paid bills. Snooze what can wait. Done in 30 seconds.

No surprises

Car insurance in March. Annual fees in July. You'll see them months ahead.

Cut subscriptions

Toggle off Netflix + Disney + HBO. See the annual impact instantly.

The Setup

First time takes work. After that — minimal.

The Audit

30-60 minGo through bank statements. Check email receipts. Gather everything that repeats — rent, utilities, insurance, subscriptions, annual fees.

Add Your Bills

15 minEnter your recurring payments. Monthly, annual, irregular — all of them. Set amounts, dates, categories.

Keep It Updated

OngoingNew subscription? Add it. Price changed? Update it. Canceled something? Remove it. Takes seconds.

30 minutes now = 12 months of clarity

Your data stays local

Stored on your device

Everything saved locally. No cloud account required. Your data never leaves your machine.

No bank connections

You add bills manually — that's the point. No credentials shared with anyone.

See your number.

Free for personal use. No trial. No limits. No account needed.